Here are 3 penny stocks to add to your watch list today:

Cheniere Energy, Inc. (AMEX:LNG): Shares up after the company announced plans to export U.S. natural gas overseas from its Sabine Pass terminal in Louisiana in a strategy shift prompted by large increases in U.S. natural gas production.

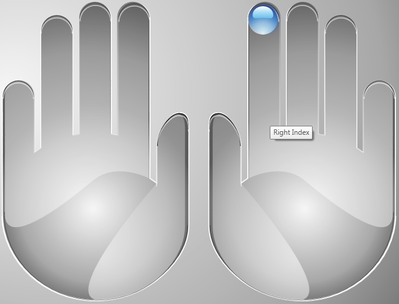

Sector 10, Inc. (OTCBB: SECI): Up 30 percent on high volume after the company announced the upcoming release of the PLX-3D integration software package and its integrated components as an easy to use mobile application for the iPhone and iPad produced by Apple.

Uni Core Holdings Corp. (OTCBB: UCHC): Up 32 percent today on decent volume. Recent developments include a new research report from Skymark Research, and plans to close the acquisition of APT Paper Group, which includes FG Management Company Limited, Global Golden Group Investments Co., Ltd., Wise Link Management Ltd., Plan Star Development Limited, and Sure Strong Limited. Uni Core Holdings Corp. is an ‘incubator’ of mid- to large-size companies in China.